Are you searching for a means to pick a foreclosed household? If that’s the case, an enthusiastic FHA loan may be the best option for you. An FHA (Government Construction Government) loan also provide of many buyers having smoother qualifications and everyday guidelines than just traditional money. Therefore, it is essential to know how these funds performs as well as their positives when considering to acquire an effective foreclosed possessions.

Contained in this post, we will speak about some great benefits of obtaining an FHA mortgage to invest in a foreclosure and you can demystify some traditional misconceptions regarding it brand of financing.

A great foreclosed home is a home the lender has repossessed due toward former customer’s inability and make payments or meet other offer words. In such a case, the lender will require fingers of the home and set it up for sale to recover the losings.

After you get good foreclosed house or apartment with an FHA financing, you can normally have more versatile terminology than just antique financial support choice. The fresh new FHA even offers low-down fee standards (only 3.5 percent) and you may informal credit rating guidelines than the antique loan providers, making it easier for the majority buyers so you can be eligible for a loan. In addition, certain lenders can even waive certain settlement costs towards the FHA funds when purchasing a property foreclosure.

To buy Foreclosures Home with FHA Financing

The procedure is fundamentally some simple when selecting good foreclosed domestic having an enthusiastic FHA loan. You could begin because of the trying to find a real estate agent otherwise broker focusing on foreclosure properties and receiving preapproved getting an enthusiastic FHA mortgage. After you’ve discovered property that suits your position, you must make a deal into the home and you may article paperwork.

However, before closing to your mortgage, you ought to undergo numerous steps, instance which have an expert appraisal done and you will entry the desired documents to own opinion. Immediately following doing these processes, the bank can provide funding for the get. It is critical to observe that any repairs or repairs with the domestic should be off the beaten track before you close on the borrowed funds.

Total, to shop for a foreclosure which have an FHA financing offers several advantages to have consumers just who may not be eligible for antique funding. Such mortgage lets them to buy a cheaper home and makes it easier to find recognized because of straight down credit history conditions.

Criteria to have a keen FHA Loan

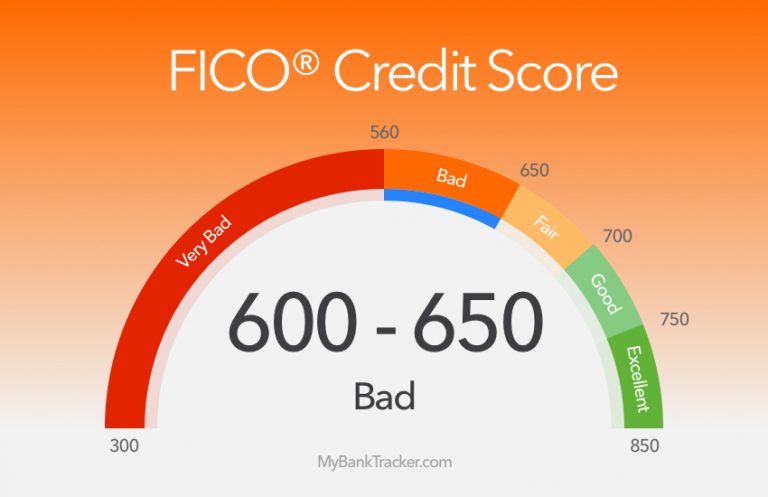

In order to qualify for an FHA mortgage, you should satisfy particular requirements. First, you will have to has a credit history with a minimum of 580 and you can have indicated a reliable source of income. Concurrently, you’re expected to pay an initial home loan cost and you will annual premium yearly.

You ought to also provide documentation appearing your residency standing throughout the Us, such a legitimate You.S. passport otherwise eco-friendly card. Additionally, you must have enough liquid assets to fund three months’ expenses additionally the down-payment towards the foreclosed property.

Borrower loan places Clermont Conditions

There are also several criteria that the borrower need certainly to meet from inside the financing techniques. Such as for instance, you should offer proof earnings, a position background, and you will recent bank comments for everyone membership for the your term.

On top of that, you’ll want to have enough quick assets to cover about around three months’ property value costs and the down-payment toward family. Finally, you need to take care of a good credit score before mortgage shuts.

Home loan insurance payments

In the long run, an option dependence on a keen FHA financing is that you need purchase financial insurance premiums. These insurance money are widely used to manage the lending company however, if your default on the loan, in addition they make up a large portion of the total price for the acquiring a keen FHA financing.