The closing entry will debit both interest revenue and service revenue, and credit Income Summary. The first entry closes revenue accounts to the Income Summary account. The second entry closes expense accounts to the Income Summary account. The third entry closes the Income Summary account to Retained Earnings.

Which of these is most important for your financial advisor to have?

In the last 10 years, she has worked with clients all over the country and now sees her diagnosis as an opportunity that opened doors to a fulfilling life. Kristin is also the creator of Accounting In Focus, a website for students taking accounting courses. Since 2014, she has helped over one million students succeed in their accounting classes.

Accounting Instruction, Help, & How To (Financial & Managerial)

The Income Summary is very temporary since it has a zero balance throughout the year until the year-end closing entries are made. Next, the balance resulting from the closing entries will be moved to Retained Earnings (if a corporation) or the owner’s capital account (if a sole proprietorship). Once we have made the adjusting entries for the entire accounting year, we have obtained the adjusted trial balance, which reflects an accurate and fair view of the bakery’s financial position. To close expenses, we simply credit the expense accounts and debit Income Summary. To close that, we debit Service Revenue for the full amount and credit Income Summary for the same.

What are Temporary and Permanent Accounts?

Thus, the Income Summary plays a crucial role in effectual financial analysis, planning, and resource allocation. Our discussion here begins with journalizing and posting the closing entries (Figure 5.2). These posted entries will then translate into a post-closing trial balance, which is a trial balance that is prepared after all of the closing entries have been recorded.

Do you own a business?

In simple terms, income refers to the money one gains in exchange for a product or labor. Every individual, business or entity gains income over a period of time. For business and entities, income may be termed as the revenue a company is generating by lending of services or products made by them. Closing entries are crucial for maintaining accurate financial records.

Balances from temporary accounts are shifted to the income summary account first to leave an audit trail for accountants to follow. The multi-step income statement provides an in-depth analysis of the financial performance of a business in a specific reporting period by using these profitability metrics. The net income (NI) is moved into retained earnings on the balance sheet as part of the https://www.bookstime.com/articles/cost-of-goods-manufactured closing entry process.

They’d record declarations by debiting Dividends Payable and crediting Dividends. If this is the case, then this temporary dividends account needs to be closed at the end of the period to the capital account, Retained Earnings. When dividends define the income summary account. are declared by corporations, they are usually recorded by debiting Dividends Payable and crediting Retained Earnings. Note that by doing this, it is already deducted from Retained Earnings (a capital account), hence will not require a closing entry.

- The next day, January 1, 2019, you get ready for work, but before you go to the office, you decide to review your financials for 2019.

- Gains represent all other sources of income apart from the company’s main business activities.

- Temporary accounts include all revenue and expense accounts, and also withdrawal accounts of owner/s in the case of sole proprietorships and partnerships (dividends for corporations).

- It reports these figures by using just one equation to calculate profits.

- Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching.

- The income statement summarizes your income, as does income summary.

- Distributions has a debit balance so we credit the account to close it.

To close the drawing account to the capital account, we https://x.com/BooksTimeInc credit the drawing account and debit the capital account. Now for this step, we need to get the balance of the Income Summary account. In step 1, we credited it for $9,850 and debited it in step 2 for $8,790.

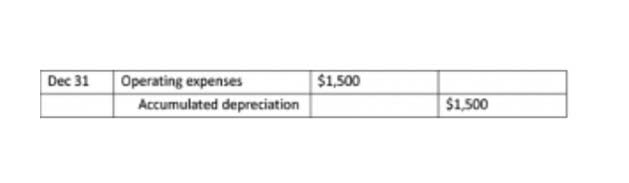

Step 2: Close all expense accounts to Income Summary

- The purpose of closing entries is to prepare the temporary accounts for the next accounting period.

- For example, closing an income summary involves transferring its balance to retained earnings.

- It starts with the top-line item which is the sales revenue amounting to $90,000.

- Any account listed on the balance sheet is a permanent account, barring paid dividends.

- Operating expenses are the expenses the company incurs through its normal day-to-day operations.

- It is the end of the year, December 31, 2018, and you are reviewing your financials for the entire year.

This way each accounting period starts with a zero balance in all the temporary accounts, so revenues and expenses are only recorded for current years. This is no different from what will happen to a company at the end of an accounting period. A company will see its revenue and expense accounts set back to zero, but its assets and liabilities will maintain a balance.