Assumable Financial: An assumable mortgage are directed about supplier on new buyer. Essentially needs a credit writeup on the newest debtor and you will lenders may charge a payment for the belief. In the event that a home loan includes a due-on-selling clause, a special visitors might not assume the mortgage.

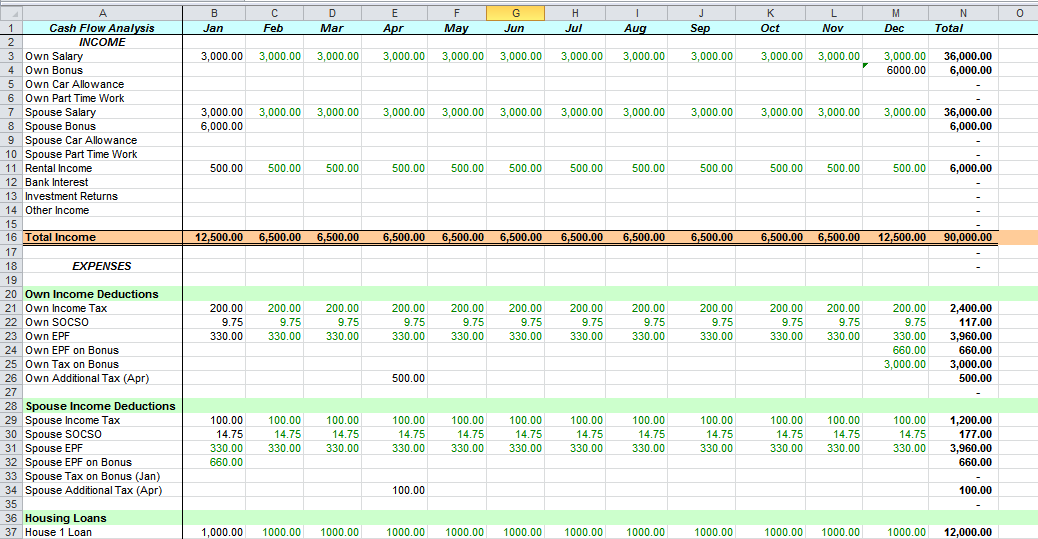

Earnings: The amount of dollars derived more a particular time frame out-of an income-creating assets

Assumption: The fresh new agreement between buyer and seller where in fact the client gets control of new money into the an existing financial from the vendor. If in case that loan usually can save the consumer money of the obtaining a current mortgage obligations, rather than getting a special mortgage in which settlement costs and you can market-rate appeal costs often incorporate.

Presumption Percentage: The price paid off in order to a lender (usually from the customer away from real property) when an assumption takes place.

Always this describes a 30-year amortization and you may a great four-year name. After the definition of of the financing, the remaining a great dominating for the mortgage arrives.

Biweekly Fee Home loan: A plan to build mortgage payments all the two weeks (rather than the standard payment per month schedule). The new 26 (otherwise twenty seven) biweekly money was for every single equivalent to one-50 % of brand new payment expected in the event your loan was in fact good basic 29-seasons repaired-speed home loan. The outcome with the debtor is actually a substantial saving into the attract.

Borrower(Mortgager): Person who enforce having and you will get that loan on mode out of home financing toward goal of paying the borrowed funds in the complete.

It may be received because of the sending DD 214 into the local Pros Items workplace having means 26-8261a (request certification regarding veteran updates; this document allows pros to get lower downpayments towards the certain FHA-covered money)

Bridge Mortgage: Another faith by which the latest borrower?s expose home is equity, allowing the fresh new proceeds to be used to shut for the yet another domestic through to the establish house is ended up selling. Labeled as an effective “swing mortgage.”

Broker: A person who facilitates organizing money or negotiating agreements to possess a client but who would perhaps not mortgage the cash himself otherwise by herself. Agents usually ask you for otherwise receive a fee because of their services.

Buy-down: If the financial and you can/or the homebuilder subsidize a mortgage of the decreasing the interest rate from inside the first few numerous years of the mortgage. Due to the fact money is actually initially reduced, they will certainly improve if the subsidy ends.

C Hats: Provisions off an adjustable-rate financial limiting exactly how much the interest rate can alter during the each modifications months (elizabeth.g., every six months, annually) or over the life span of financing (price limit). A repayment cap restrictions how much this new payment due toward loan increases otherwise fall off.

The money move will likely be adequate to blow the expenses of money-promoting possessions (mortgage repayment, fix, tools, etcetera.).

Certificate from Qualification: The fresh https://paydayloanalabama.com/selma/ new document made available to licensed veterans entitling these to Va-protected financing to have residential property, enterprises and cellular house. Permits out-of qualifications can be gotten by the delivering means DD-214 (Break up Report) towards local Pros Affairs office that have Va setting 1880 (request for Certification out-of Eligibility).

Certification away from Seasoned Position: Brand new document supplied to veterans or reservists with supported ninety times of proceeded productive responsibility (as well as knowledge time).

Closing: The fulfilling at which a property sales is signed. The buyer signs the loan, pays settlement costs and you will obtains label to the family. Owner pays closing costs and you can gets the online proceeds from the home sales.

Settlement costs: Costs along with the cost of your house obtain by buyers and you can vendors whenever property is actually soldmon closing costs become escrow charges, title insurance fees, file recording charges and you can a home earnings.