You to ability one Financial Australia did better inside the sales the articles is because they has Frequently Expected Questions’ towards the bottom of one’s display screen, assisting users to get advice easily and quickly

In britain, Barclays even offers a crossbreed off academic articles additionally the key guidance some body need to know so you can pick the best mortgage equipment. That have a massive selection of blogs to own basic home buyers and you will folks in between, Barclays targets more field markets through its academic stuff. Although this stuff centre is really what consumers require, they might make the most of redirecting people so you can in the-people group meetings and collecting trick consumer pointers using acquiring their letters otherwise phone numbers.

Seeking to the united states, the financial institution away from The usa lacks informative blogs toward first domestic consumer however, has a straightforward financial calculator which is easy-to-understand and perform. In addition, they offer of numerous possibilities to connect with a home loan expert assisting to bring crucial customers guidance and nurture buyers relationships constant.

Finally, Bank Australian continent also provides a simple and clean screen that exhibits an important guidance due to their four some other home loans. If you find yourself Financial Australian continent will bring pointers from inside the an obvious and you can instructional method, they hinges on the user to understand your house loan processes. They also have a long-term Apply’ icon and you can Enquire’ icon at the top of the latest webpage when people search, guaranteeing prospects and permitting these to acquire secret user recommendations.

Full, Financial out-of The united states, Barclays and the Financial of Australia mostly focused the advice so you’re able to those who currently know mortgage brokers and you may whatever they was basically looking for. While Barclays did good jobs away from bringing a content hub of instructional content, another two banking institutions you will make the most of along with hyperlinks to help you where users can acquire instructional information to help build faith, respect and you will a powerful customer relationships. Funnelling consumers to contact the lending company is a fantastic technique for wearing crucial customer recommendations and offers the ability to one another generate and you can cultivate important guides. This was done effectively thanks to multiple website links and you will pop music-ups.

Social networking posts

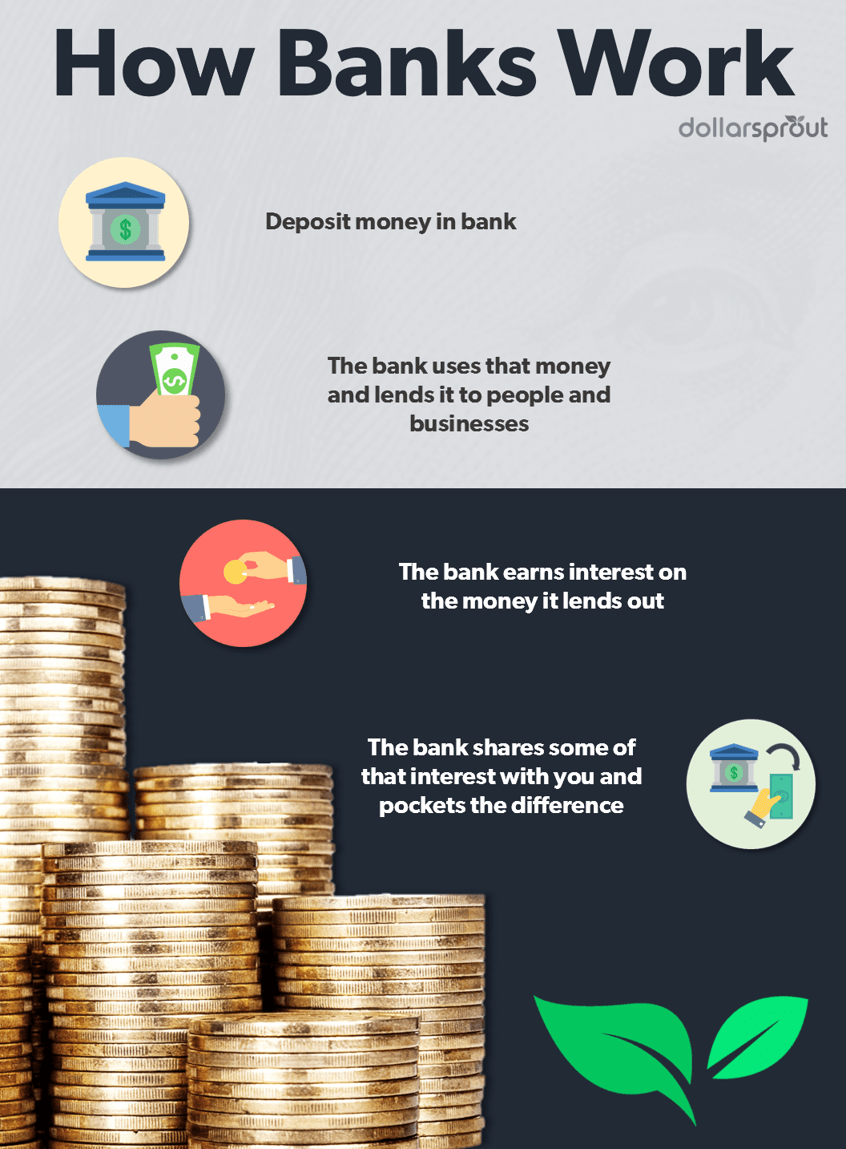

Instead of their other sites which offer recommendations to people one to currently know home loan procedure, social network is employed for degree and you will providing basic home buyers comprehend the lending process. Having instructional listings that give step-by-action books into the mortgage process, social media is actually a deck that intends to do genuine customer dating as a result of effortless-to-understand content. Of several lenders are efficiently using its social media channels by the enabling chatbot messaging. Towards Myspace and you can Instagram, loan providers prompt customers to inquire about issues, inquire about mortgages, and ask for information doing numerous user touchpoints.

Social media stuff toward Instagram, YouTube, and Hillsboro loans Twitter is much more into the-line across-the-board as to what customers are trying to find predicated on the brand new TD Home loan Provider Index Statement, because it’s informative, simplistic, and helps to create an individual connection with users. On LinkedIn and you can X financial company was centered regarding the business and its situations as opposed to the buyers.

- Perform informative and simple-to-learn posts to simply help change customers.

- Use chatbot and you will messaging enjoys to simply help users and possess nurture prospects

- Would relatable blogs one to connects with pages psychologically.

Around australia, Aussie, a home lender and you will mortgage broker, utilises Instagram, Facebook and you will X. While X was used only for upgrading consumers with the Aussie’s charity issues and you will small business ventures, Fb and you will Instagram are accustomed to teach and construct buyers relationship. Undertaking carousels toward Instagram one describe all aspects of the house mortgage procedure, for both knowledgeable consumers and you can earliest home buyers, Aussie stops working advanced subject matter into small and digestible pockets of data. On Facebook, Aussie leans heavily with the short films posts concerned about degree and you will exhibiting genuine Australian reports, strengthening higher faith and you may visibility that have visitors.