Imagine converting your house in the fantasy liveable space instead of cracking the lending company. Refinancing for renovations helps make which you’ll by the assisting you make use of the residence’s security to finance your own repair endeavor and potentially adding more worthiness on property.

Within full guide, we’re going to walk you through the new ins and outs of refinancing for renovations and give you the details you should build an educated choice.

Small Summation

- Refinancing your property financing having home improvements try a process that allows homeowners to view funds to have house home improvements when you find yourself possibly protecting much more beneficial financial words.

- Think newest financial terms and conditions, rates of interest, financing charges, and you may closing costs in relation to refinancing getting a restoration.

- Shopping around to find the best lenders and working that have knowledgeable pros, like a mortgage broker towards you that have high recommendations, can help you achieve the finest outcome when you look at the refinancing your residence financing getting home recovery plans.

Skills Refinancing otherwise Cash-out Re-finance

Refinancing or cashing aside equity out of your home financing to fund renovations, essentially comes to replacement your existing financial with a brand new one to to access money for house lesser otherwise major home improvements while potentially securing most readily useful mortgage conditions with the new house security loan.

This approach can offer several benefits, like the capacity for dealing with you to definitely mortgage and loan money, together with possibility to safer more favorable mortgage words.

The way it works

When you look at the property collateral mortgage refinance, you will get extra capital by the refinancing which have a lender and you can increasing the mortgage count, utilising the collateral in your possessions to fund the fresh new renovation.

Particular mortgage brokers give keeps particularly counterbalance levels and redraw facilities, and that allow property owners and then make additional payments to their mortgage otherwise a linked membership, and thus reducing the attract payable towards the financing.

But not, it’s imperative to gauge the much time-identity implications away from being able loan places Coats Bend to access money by way of these institution on the household financing payments. Therefore, exactly what are the benefits associated with good refinance on reason for remodeling?

Great things about property recovery loan

Refinancing to possess family home improvements also provide residents which have most loans having the repair plans, and potential to straight down interest rates, cure monthly installments, and offer so much more self-reliance about recovery financing terms.

Because of the refinancing, you will be capable safe a diminished interest and expanded payment terms, making the renovation endeavor inexpensive eventually.

Deciding Your residence Security

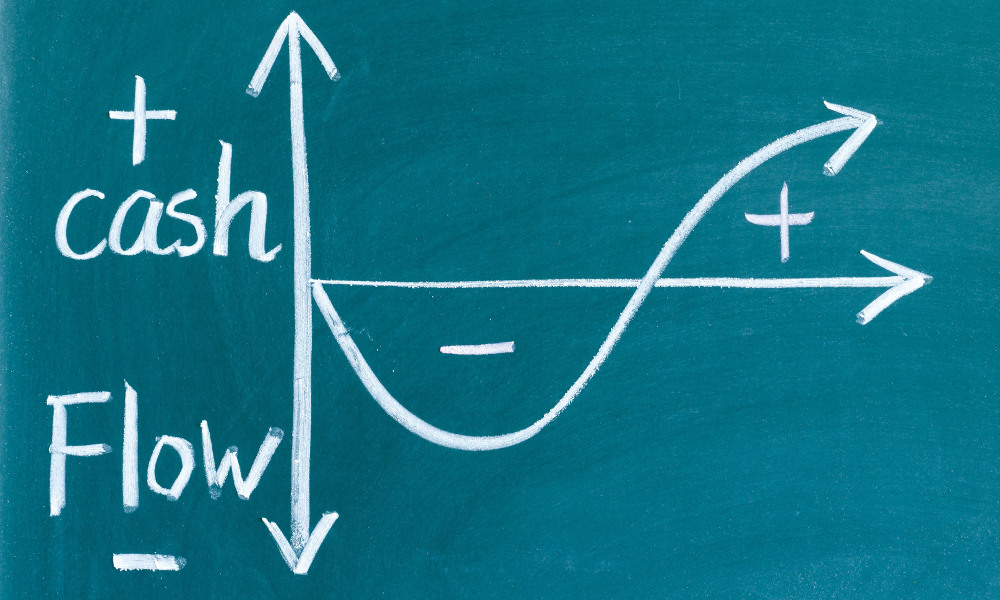

The guarantee takes on a significant role inside the capital their repair opportunity. Equity is the difference in your own house’s economy well worth and you may the new a good mortgage balance.

To help you use your collateral to possess a repair venture, you will want to determine the guarantee and you may understand how it does be taken getting refinancing.

Refinancing is a wonderful way to availableness equity of your house. It permits one to put it to use into different wealth building methods such as for instance committing to assets/shares otherwise adding value so you can an existing possessions. You can also explore collateral so you can consolidate obligations.

Calculating security

To determine the collateral, subtract the amount you owe in your home loan on the newest market value of your property. This will make you a sense of how much cash security you have available to tap into for your home recovery.

Having fun with guarantee to own refinancing

Home owners can also be power its guarantee of the refinancing their financial locate fund to own renovations. The first step within the using security for refinancing is to find an effective valuation of the home, as numerous lenders want a great valuation to evaluate the amount of chance you introduce also to include on their own.

Before carefully deciding to help you borrow cash against equity, check your financial allowance any extra debt and don’t imagine you can access the quantity of the security. All the financial keeps more guidelines to simply how much equity you can availability therefore the rates of interest you would have to pay.