Latest Even offers

Discovered an ending commission waiver out-of $150 which have Comerica Small company Much easier Capital to own unsecured title financing and credit lines from $ten,000 to $100,000.

Discover a closing commission waiver around $400 with a Comerica secured otherwise unsecured title mortgage otherwise line out-of borrowing from the bank out-of $100,001 to $750,000.

Faith a number one Financial getting Providers*.

You have struggled to establish your online business. Assist Comerica’s unrivaled experience and you can opinion bring it then. Whether you’re broadening otherwise preparing for challenges ahead, obtain the pricing and you will guidance you need to keep your providers progressing.

Delivering financial support is not much easier.

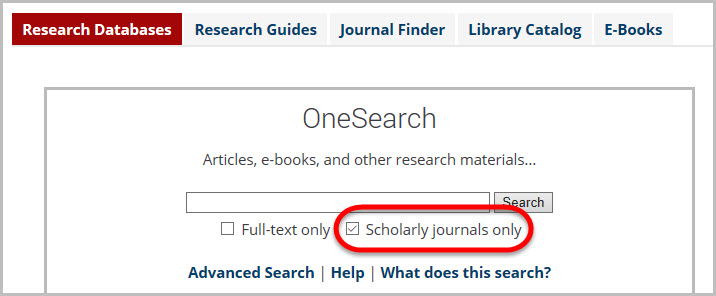

Our digital small company financing program, Comerica Small company Simpler Investment, increases use of money and offers quicker approvals and you can investment. It solution is used for unsecured term funds and you will outlines away from borrowing from the bank around $100,000. step three To have money of any count count on Comerica to the solution that’s true to suit your needs.

- Sleek into the-person and you will notice-serve digital programs

- Zero taxation statements needed 4

- Instant choice or even in only a day

- On the internet buyers acceptance

- eSign electronic financing closing

- Funding contained in this as little as 72 era

Willing to find out how a Comerica Small company Banker may help you see suitable mortgage choice for your business.

Having a limited time, save your self $150 on closing costs step 1 – select a financial cardio place near you to get going.

Term Finance

Comerica knows your business features unique pressures, therefore we bring novel business loan choices, supported by the new recommendations you ought to reach your requirements.

Personal lines of credit

Without question. A whole lot more small businesses falter because they do not has actually adequate capitalization than for any other cause. In secured and you will unsecured options, a business credit line lets you make use of funding, pay it back and borrow again when it’s needed.

Unsecured team line of credit Acquire around $100,000 Protection cash flow timing openings, availability brief-label working-capital and you can resolve most other business requires no guarantee needed.

Secure organization credit line Borrow around $five hundred,000 Loans seasonal list, increasing receivables and enormous quick-term working capital means. Flexible security options become real estate or other organization property.

SBA Loans

Adequate capitalization could possibly be the trick ranging from achievements and failure. Regardless https://paydayloanalabama.com/sylacauga/ if you are growing your organization, to shop for gadgets otherwise home, otherwise refinancing established financial obligation, a good Comerica Small business Management (SBA) Mortgage provides financing to simply help your business build. Supported by our experience, proportions and you can National SBA Prominent Bank reputation, our very own small business specialist promote money less, that have fewer difficulty.

- Use around $500,000 on competitive pricing

- No Guaranty Costs Due during the Closing

Commercial A home Funds

Get the resource you will want to buy, re-finance otherwise revise assets for your needs – that have versatile terms and conditions which make payments down.

Collateralized by the assets, a professional home loan is actually a reasonable means to fix buy, create, re-finance otherwise remodel holder-filled commercial possessions and you may property.

*Comerica ranks earliest around the world certainly one of U.S. lender holding people which have greater than $70B from inside the assets, predicated on industrial and industrial fund an excellent due to the fact a portion out-of assets, as of . Studies provided with S&P Around the world Markets Cleverness.

1 Discover an ending commission waiver away from $150 to the on the web programs recorded anywhere between , in case your mortgage closes from the erica Lender reserves the right to tailor otherwise cease also provides anytime.

2 For business finance out-of $100,001 so you can $750,000, receive doing a closing percentage waiver away from $eight hundred to the software filed ranging from , of course the mortgage closes by the . Charges differ by the financing typeerica Lender reserves the legal right to tailor otherwise stop now offers any time.

step 3 Having small company customers with as much as $1 million inside aggregate Comerica company loan needs. Readily available for the brand new loans merely; can not be used to refinance existing Comerica loans. Good Comerica business bank account required; must be open for around 120 months to utilize.

Funds susceptible to credit acceptance. Mortgage proceeds must be used entirely for company motives. Terms and conditions, conditions, fees, or any other constraints could possibly get incorporate. Cost was subject to transform and you can believe terminology.