Content

Tools such as the Fidelity stock screener, stock research dashboard and the robust Active Trader Pro platform help users identify attractive investment opportunities. At other brokers, selling order flow helps compensate for revenue lost by offering commission free trades but often results in compromised execution quality. Mobile traders can take advantage of advanced order types such as trailing stops and OCOs . Risk-free paper trading is also possible on mobile using the virtual paperMoney account.

CMC Markets is home to an award-winning trading platform that is compatible with desktop browsers, Android, iOS, and tablets. Getting in and out of the market and taking small profits continually throughout the day requires efficient order execution. As a direct access broker, customer orders can be routed to over 100 destinations, including exchanges, market makers and dark pools.

- IG also offer excellent in-platform support that can help you to make decisions in moments using the free powerful tools built into the platforms.

- If you trade using this money, a process called margin trading, you may magnify any losses you incur.

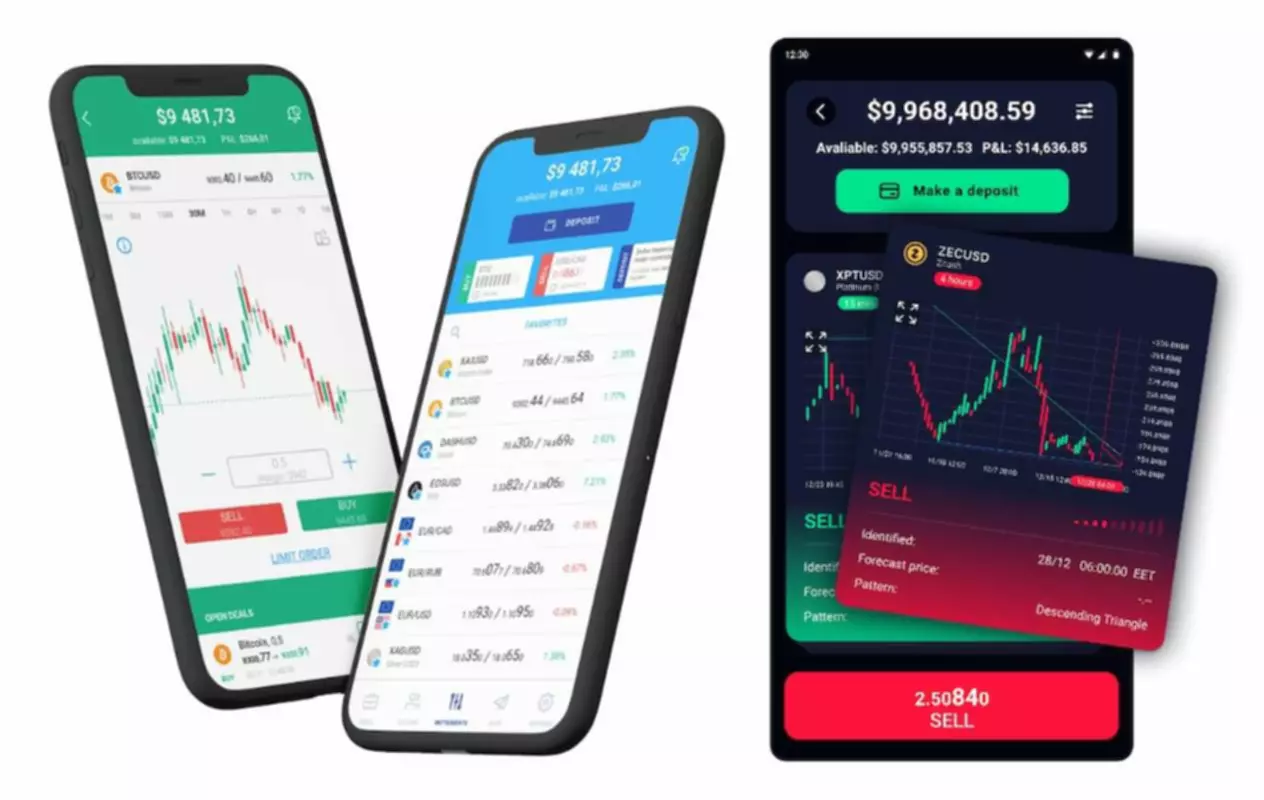

- Like other newer brokers, Trading.com has taken a mobile-first approach, meaning that account holders may find trading from a phone simpler and more intuitive than the brokerage’s web app.

- The platform does provide all the tools you need to build automations – and unlike MetaTrader 4, does not require EAs.

- Swap cannot be charged in Islamic forex brokersor swap free forex brokers.

That being said, it does have some really useful features which will be a help to some investors. For starters, it has a vast amount of research material as well as some useful tools you can use to analyse the markets. You can also choose from ready-made portfolios, get help choosing stocks, ETFs and funds to invest in, and take advantage of the latest news and expert tips. This includes markets in the US, Canada, Asia, Europe, Australia, and more. If you’re also interested in a shorter-term day trading strategy, Fineco offers thousands of CFD markets. As well as stocks, this includes forex, hard metals, energies, indices, and more.

One area where Cobra Trading stands out is in making it easy to short sell low priced securities and penny stocks. Easy to Borrow lists are regularly updated by brokerage firms and made up of highly liquid stocks that can be sold short immediately. However, some stocks favored by day traders are not so readily available for short selling. https://xcritical.com/ These are often small cap or penny stocks that are attractive in part because they are highly volatile. This feature is unique among the ones offered by professional trading platforms. TradeStation gets an honorable mention in our listing, thanks to its combination of long-tested trading technology and in-depth research resources.

Open an Account

MetaTrader 4’s breadth and depth of features, as well as the straightforward interface, have helped make MetaTrader 4 the most-used trading platform across the globe. The platform also stands out from the competition for its emphasis on customization. It’s a mainstream platform that actively encourages integrations from numerous third-party APIs and other tools. This means that with an account balance of just $200, you could potentially trade with $40,000. As always, you might be offered lower limits – especially if you are based in Europe and you’re not deemed to be a professional trader.

Yahoo Finance is working hard to make its charting system a good alternative to other free vendors. Yahoo has updated its interactive charting experience, it is a clean experience and full screen, so now it is quite good. With 114 different technical indicators, you are well covered with Yahoo Finance.

Not forgetting that it supports one of the most diverse financial instruments. Saxo Markets is a one stop shop for day traders, offering 60,000 global stocks, options and CFDs on forex, bonds, indices and commodities. Along with a suite of advanced trading tools to choose from, Saxo offers 24/hr support via phone or live chat. IG has some of the lowest fees around, offering $0 brokerage on global stocks and $5 for Australian stocks if you make at least 3 trades per month.

Ideally, this should be with the British FCA – which is responsible for keeping United Kingdom trading and investment industry safe and transparent. By sticking with an FCA broker in the UK, you will benefit from a range of safety nets. Hargreaves Lansdown is an extremely secure broker that’s licensed by the FCA. It also offers a useful mobile app so you can trade on the go, and if you ever need assistance you get in touch with the customer service team via email or telephone.

With safety and security features only a top platform can offer, Discount Trading is an excellent choice for those looking for reliable service. Stocks, ETFs, and options can all be traded within the same platform, which is very convenient. There being no inactivity fee is great news for those looking to take a break from trading every so often or who don’t trade as much. They also offer a transparent pricing structure with low commissions that is easy to understand.

Forex trading platforms can also make money by charging fees related to deposits, withdrawals, overnight funding, and inactivity. The top forex trading platforms that we came across offer a huge selection of everyday payment methods. For example, eToro not supports instant deposits in the form of debit and credit cards, but e-wallets, too. For example, some accounts offer zero commissions and wider spreads, while others allow you to trade currency pairs at 0 pips. If you’re a newbie, FXTM offers a good selection of educational and research tools. This will allow you to become a better forex trader over the course of time.

Best Online Broker for Traders

Some are better for long-term investing, while others are great for tracking your spending and investing what would otherwise have been spent. Permalink Even with the bullets flying next year, lawmakers may still find a path through this neutral territory to briansclub cm make crypto legislation happen. The app is not responsive in nature and can be viewed best on a desktop or laptop. Another plus point with Speed Pro is faster execution of orders and real-time monitoring.

The process is wholly automated, but you have absolute control over your choice of trading instrument and popular investors whose trade settings you wish to copy. When copying strategies, you are free to adjust such factors as the trade amount and risk exposure levels. We provide tools so you can sort and filter these lists to highlight features that matter to you. Zero brokerage share trading on US, Hong Kong and European stocks with trades as low as $50. Trade up to 35,000 products, including shares, ETFs and managed funds, plus access up to 15 major global and Australian stock exchanges. We used Finder’s proprietary algorithm to find brokers that offer the best selection of tools and to nail down those with the most attractive fees for high frequency traders.

IG’s direct market access means it provides electronic communication network -style trading conditions, with speeds comparable to straight-through processing on some accounts. It’s not quite real-time trading such as you might get with direct access to the forex market, but it’s close. By choose a forex trading platform that is regulated by one or more of the above bodies – you can rest assured that the provider is safe. This is also the case with indices, commodities, and digital currencies like Bitcoin and Ethereum. If you’re also keen on trading stock CFDs, XTB will charge you a very small commission of 0.08% per lot.

How do I start a trading account for beginners?

Based in Canary Wharf, London, the broker has been offering access to over 40,000 instruments across a wide range of asset classes. In terms of regulation, Saxo Markets is authorised by the UK Financial Conduct Authority and is a popular UK trading platform for CFDs. Either way, buying trading assets at Fineco will attract an annual maintenance fee of 0.25%. For example, stock CFDs are commission-free, while futures CFDs cost $0.70 per contract.

TradeStation offers direct-market access, automatic trade execution and tools for customers to design, test, monitor and automate their custom trading strategies for stocks, options and futures. TradeStation Simulator allows users to test out new investing strategies before putting any money on the line. TD Ameritrade offers two main trading platforms, each with a corresponding mobile version. TDAmeritrade.com has just about everything an average investor needs to identify, research, screen and trade stocks, funds, bonds and CDs.

eToro Copy Trader – Overall Best Algorithmic Trading Platform

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site. For example, you might receive a notification if a major forex pair breaches a key residence line. Or, the platform might notify you when a news story breaks that could influence the future price of a currency pair.

An excellent option for US forex traders looking for low trading costs, tights and a powerful platform to support technical trading strategies. Of all the US forex brokers we profiled, Trading.com alone has gone all-in on MetaQuotes’ next-generation trading platform. And while this broker may lack some of the bells and whistles of other older, pricer brokerages, it’s hard to argue types of brokers with tight spreads and low trading costs. Contrary to its reputation as a ‘discount’ broker, IBKR offers US account holders a full suite of trading tools. Low trading costs, in this case, don’t translate into a low-quality trading environment. The broker offers a reasonable portfolio of tradable assets, together with standard analysis, charting and market research tools.

How much can you make when algorithmic trading?

Similar to MetaTrader 4 with many of the same features, thinkorswim edges out the popular third-party platform with its addition of some attractive features, such as depth of market views. Used by over 500,000 users, this platform empowers you with top-notch charting and analysis. These indicators are supplemented with Market Analyzer, a feature unique to NinjaTrader that identifies opportunities in real-time. Opting for MetaTrader 4 has several advantages, including access to EAs to automate your trading and additional indicators beyond those native to the platform. TradingCentral for extra charting and Reuters for news services and market research are also available.

OANDA Accounts and Products

Some robo-advisors also offer access to the know-how of human portfolio managers, although this tends to make them more expensive. Robo-advisors were designed for hands-off investors who would rather pass off investment decisions to professional managers, a computer algorithm or a combination of both. If you want to learn more about this type of platform, we recommend you take a look at our list of best robo-advisors. The three main things to consider when choosing an online trading platform are your investment experience and style, your trading needs, and your personal finance goals. Merrill Edge’s provides access to a wide variety of educational material and research tools for clients to use.

Ques-Which factors make a stock broking firm the best in India?

An infinite number of timeframes are available, and traders can compare up to four in a single chart. Charts can also be split into multiple frames to better help you visualize different markets and include extra monitoring tools. Along with watchlist and price alerts, US forex traders can opt to integrate third-party solutions like Autochartist or PIA First for trading signals. With over 20 years of investing experience and 10 years of trading, Justin co-founded Compare Forex Brokers in 2014. He has worked within the foreign exchange trading industry for several years and for several of the largest banks globally.

This broker is slightly different from others in that while it offers CFD trading, it also offers spread betting. With spread betting, any earnings you make from your trading are tax-free. You can also download the mobile app for iOS and Android devices if you wish to transact on the go. FXTrader is an order management tool that aggregates quotes from 14 major interbank dealers. In addition to Trading with Forex.com, traders with Standard and Commission accounts can choose between MetaTrader 4 and NinjaTrader.